CEF Lead Executives

-

ANDREA BARRACK

SVP, Sustainability and Impact

Andrea is responsible for RBC’s sustainability strategy and is also Executive Director of the RBC Foundation. Her mandate includes delivery of measurable societal, employee, brand and business impact through community investments. Prior to joining RBC, Andrea was Global Head of Sustainability and Corporate Citizenship at TD Bank. She also served as an Executive Advisor on ESG, Sustainability and Climate Change at Deloitte, and as CEO at the Ontario Trillium Foundation. An active volunteer, Andrea participated on the Board of the International Planned Parenthood Federation at the regional, national, and global level for over 15 years. She is currently an Executive in Residence at the Rotman School of Management at the University of Toronto and teaches in the ESG Certification Program. Andrea earned a Master of Health Science in Health Administration at the University of Toronto. In 2016, she was named in the Women’s Executive Network Top 100 Most Powerful Women in the Trendsetter and Trailblazer category.

-

DANA HUMMEL-SMITH

VP, Sustainable Finance

Dana is responsible for driving the integration of environmental, social and governance (ESG) factors into RBC Capital Markets’ Corporate Client and Global Markets advisory businesses. Dana joined RBC in 2017 in Corporate Banking in New York supporting lending transactions to Consumer & Retail clients and working closely with the Sustainable Finance Group to build out RBC’s capabilities in sustainability-linked loans. Previously, Dana has held roles in ESG consulting for asset management firms and in sell-side credit research at Bank of America Merrill Lynch and Goldman Sachs. Dana earned her Bachelor’s in Finance from Virginia Tech and is a Sustainability Accounting Standards Board (SASB) FSA Credential Holder.

-

EMMA ROGERS

Sr. Director, Climate Strategy

Since joining RBC in 2017, Emma has worked on the climate strategy with a focus on evolving the bank’s ambition and integration with the bank’s business and functions. Emma now leads a team working on the climate strategy, integration and governance. Emma has 15 years of experience in sustainability strategy, business management and policy development, and brings a unique combination of corporate and public sector perspectives to new challenges. Prior to joining RBC, Emma worked for the provincial government on environmental policy files. She also worked at Tim Hortons and Sears Canada on sustainable procurement, sustainability reporting, marketing and environmental compliance. Emma received her M. Sc. in Environmental Management and Policy from the International Institute for Industrial Environmental Economics at Lund University, Sweden. She is a mother to two daughters, a painter and loves spending time in the outdoors.

-

MOSES CHOIList Item 1

Managing Director, Sustainable Finance

Moses collaborates with institutional clients to deliver innovative sustainable finance solutions across RBC’s investment banking and global markets platform. As a part of RBC's commitment to invest $1Bn into innovative climate solutions, Moses also leads coverage of climate investment funds and portfolio companies. Moses was previously Head of Digital and Sustainable Finance within the corporate venture capital team at Orange and has held corporate and investment banking roles at Citi and Morgan Stanley. Moses has been an Executive Committee Member of the ICMA Green Bond Principles and Board Member of the Impact Capital Forum. Moses holds BA and BSc degrees from Cornell University and a master's degree from the Fletcher School at Tufts University.

-

CLIFFORD MANN

Sustainable Finance

Clifford is an analyst on RBC’s Sustainable Finance Group where he supports institutional clients as they navigate the transition to net-zero, providing bespoke ESG advisory services, sustainable debt origination and structuring, and thought leadership. Prior to joining RBC, Clifford worked in social enterprise consulting across sustainable real estate, financial inclusion, and affordable housing. He has also published academic research on the effect of a corporation’s voluntary disclosure on consumer patronage. Clifford holds a degree in Policy Analysis and Management from the Brooks School of Public Policy at Cornell University.

Latest Sustainability Reporting

(April 2025)

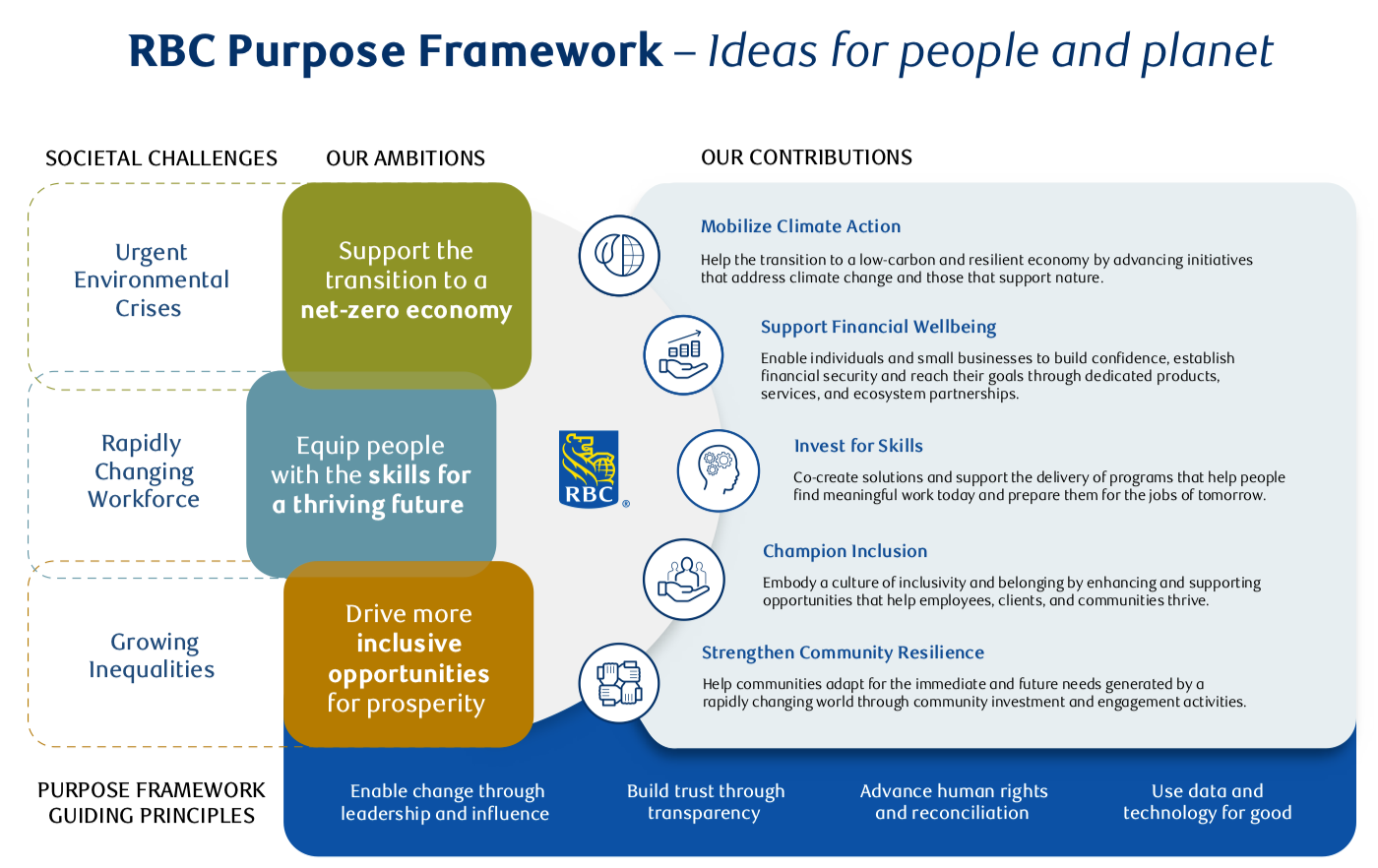

Highlights

- Reduced global operational emissions 63% in 2024 (2018 baseline).

- In 2024, reduced absolute financed emissions from oil and gas by 1% from 2023.

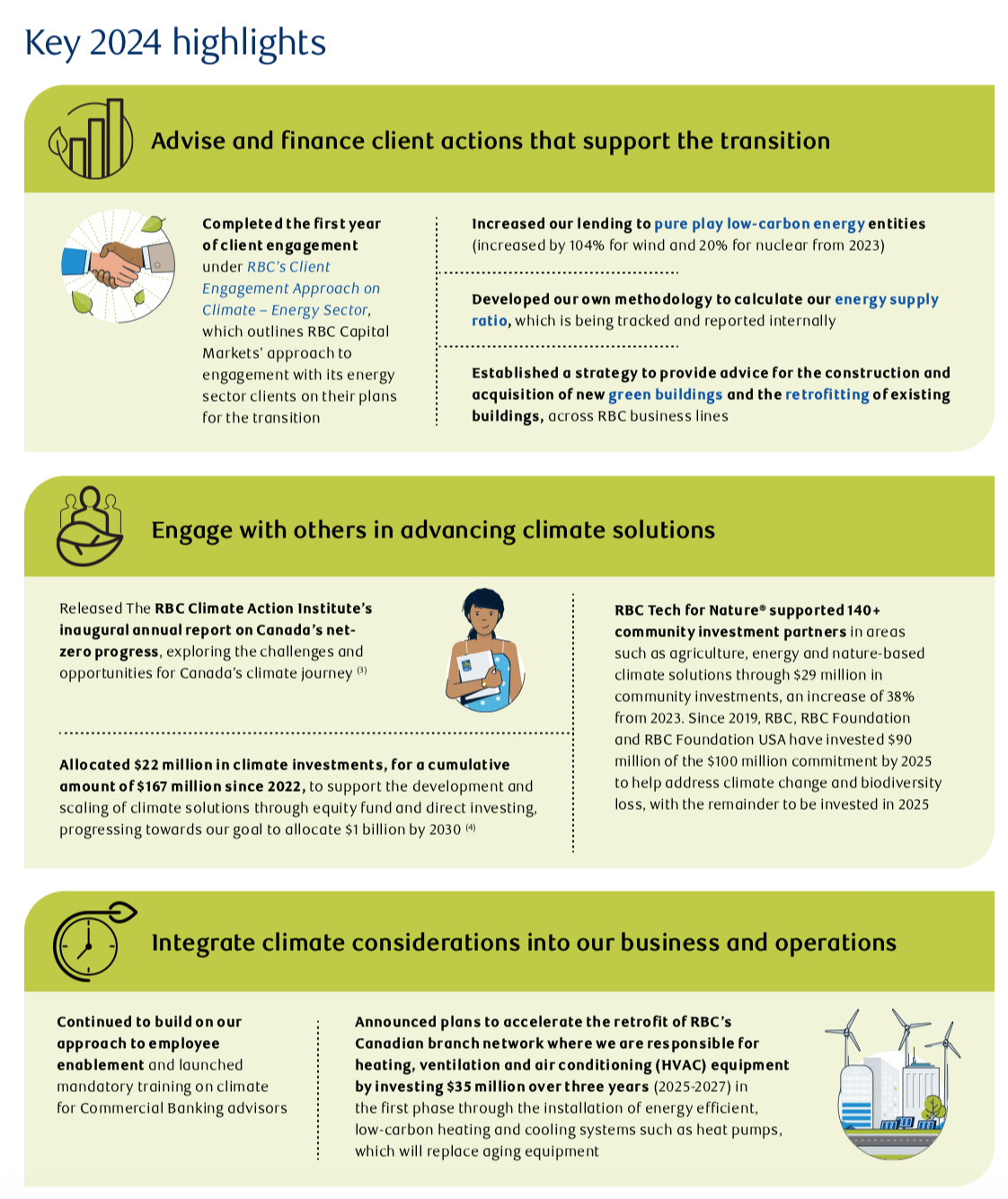

- Increased lending to pure play low-carbon entities to $12.5 billion, up 33% over 2023.

- Allocated $22 million in climate investments to support the development and scaling of climate solutions, for a cumulative investment of $167 million since 2022.

- Committed to provide $7 billion in financing for the construction, retrofitting, and renovation of affordable and sustainable housing in Canada over five years.

- Established a strategy to provide advice for the construction and acquisition of new green buildings and the retrofitting of existing buildings across RBC business lines.

- Announced plans to retrofit RBC’s Canadian branch network by investing $35 million over three years, starting with installing energy efficient low-carbon heating and cooling systems.

- Supported climate solutions efforts of over 140 community investment partners

through RBC Tech for Nature, with

$29 million in investments, up 38% from 2023.

Recent News

2024

MICROSOFT / ROYAL BANK OF CANADA — Agreed to purchase 10,000 tons of CO2 removal credits over 10 years from Deep Sky Labs, Canada’s first commercial direct air capture (DAC) facility. Deep Sky will use eight different DAC technologies with the aim of measuring and optimizing their performance year-round (accounting for the Canadian climate). The technologies will be powered by renewable energy and CO2 will be stored in permanent carbon storage. (Nov 2024)

PR » BLOOMBERG »

Announced a plan to retrofit its 1,200 Canadian branches, aiming to cut 10,000 metric tons of onsite carbon emissions from its operational footprint. In the first phase, RBC will invest $35 million over three years on energy-efficient low carbon heating and cooling systems. (July 2024)

New York City (NYC) reached agreements with JPMorgan Chase, Citi, and Royal Bank of Canada for the banks to regularly disclose their "Energy Supply Ratio" (financing ratio of low-carbon energy to fossil fuels) and their underlying methodology. The agreements come after successful shareholder engagements by the NYC Comptroller and three of NYC’s pension funds (who also have Energy Supply Ratio shareholder engagements with three more banks outstanding). (April 2024)

Announced three new actions it intends to take to accelerate the transition to a greener economy: 1) Triple lending for renewable energy across RBC Capital Markets and Commercial Banking and grow overall low-carbon energy lending to $35 billion by 2030; 2) Allocate $1 billion by 2030 to support the development of innovative climate solutions; 3 ) Accelerate capital deployment to emissions reduction efforts with a new decarbonization finance category. (March 2024)

2023

Joined the CEF member network in May 2023!

Launched the RBC Climate Action Institute to bring together research insights and industry experts to help clients and communities apply climate solutions across key sectors of Canada's economy. The institute will work closely with businesses and industry partners to design practical ways to reduce net emissions. It will focus initially on buildings & real estate, agriculture, and energy systems.

Announced that in 2023 it will add climate objectives to the CEO and group executives’ mid-term and long-term incentive plans. As RBC notes in its 2022 Climate Report, this will serve as “an additional incentive for the CEO and GE to accelerate RBC’s progress on these key priorities through innovation and engaging with governments, businesses and individuals to facilitate meaningful global progress towards net-zero over the short, medium and long term.” (March 2023)

2022

Royal Bank of Canada (RBC) set 2030 interim targets for three sectors: oil & gas, power generation, and automotive. For oil & gas, RBC aims for a 35% reduction in Scope 1 and 2 emissions intensity and an 11-27% reduction in Scope 3 emissions depending on government policies over that period. For power generation, RBC will aim for a 54% reduction in Scope 1 emissions. For automotive, the bank is aiming for a 47% reduction in Scope 1, 2, and 3 emissions. RBC is also aiming to provide $500 billion in sustainable finance by 2025. (Oct 2022)

2021

RBC committed to net-zero emissions in its lending portfolio by 2050 and announced an increased commitment to mobilize $500 billion in sustainable finance by 2025, after successfully fulfilling its first $100 billion in 2020. It also plans to achieve net-zero emissions in global operations by 2025 by reducing GHG emissions by 70% and sourcing 100% of its electricity from non-carbon emitting sources. (March 2021)