CEF Lead Executives

-

ELLEN GLAESSNER

SVP, U.S. Head, Sustainability and Corporate Citizenship and Senior Advisor to the CEO, AMCB

Ellen leads a hardworking and innovative team that is growing commercial opportunities for environmental and social issues, building out TD Bank's US sustainability program, managing climate change risks, and innovating philanthropic and charitable solutions to invest in the communities where we live and work. She serves as Senior Advisor to the CEO and President of TD Bank about mission-critical issues and strategic objectives. Ellen previously served as General Counsel for TD Bank, where her team advised the company’s various business lines as they rolled out new products, implemented regulations, and addressed consumer and business needs. Ellen has spent much of her career in the financial services industry, taking on increasingly senior roles at TD, ING, Morgan Stanley, Citigroup, and JP Morgan Chase. Ellen graduated from Wellesley College with a B.A. in Economics and History and earned her J.D. from Columbia University. She is admitted to the Bars of the State of New York, the State of New Jersey, and the State of Texas.

-

AMBER TOFILON

Head, US Sustainability

Amber leads TD’s ESG program in the US. Amber’s team brings essential US insight and perspective to TD’s enterprise ESG initiatives, including on the evolving US landscape. Prior to her current role, Amber practiced law as a bank regulatory lawyer for TD. When not working, Amber enjoys hiking, cycling, and yoga. She lives in Maryland with her husband, two children, and two cats.

-

MOLLY MILLERWISE MEINERS

Head of Corporate Reputation

Molly works to protect and strengthen the bank's reputation with policymakers and other key stakeholders, while amplifying TD's work to create economic opportunity and mobility for customers and communities. Molly was previously a partner at the global advisory firm, Brunswick Group, where she worked with some of the world’s leading financial services companies to help them navigate legislative, regulatory, and reputational challenges. Molly spent over a decade in public service, including at the U.S. Department of the Treasury as Principal Deputy Assistant Secretary for Public Affairs and Senior Advisor to the Under Secretary for Terrorism and Financial Crime. Molly also served as Chief Communications Officer at the U.S. International Development Finance Corporation (formerly the Overseas Private Investment Corporation - OPIC) and as press Secretary at the Committee on Ways and Means. Earlier in her career, Molly was a Director on the Corporate Communications team at Citigroup Inc. Molly is a native of Michigan and lives with her family outside of Washington, D.C.

-

CHRISTINE RHODES

AVP, ESG Reporting and Measurement

Christine is an experience leader who has worked in sustainability for 15 years, holding executive positions both in the financial services industry and as a consultant. At TD Bank, she currently serves as the Associate Vice President of ESG Reporting and Measurement, leading the team responsible for all aspects of environmental, social and governance reporting as well as stakeholder engagement and insights. She serves on multiple committees focused on building the future state of sustainability at TD as both chair and member. Prior to joining TD, Christine spent 15 years at 'Big 4' professional services firms where she rose to the rank of Associate Partner and served in client-facing market leadership roles consulting for companies and investors on the development and implementation of ESG strategies. Christine is a Chartered Financial Analyst and an experienced non-profit board director. She holds a Bachelor of Commerce degree and multiple risk management designations.

-

NICOLE VADORIList Item 1

AVP and Head of Environment

Nicole leads a team of subject matter experts to provide innovative solutions to today's business and environment challenges. Nicole oversees a diverse portfolio which includes initiatives geared at greening the Bank and its products and services, proactively managing environmental risk within banking activities, advancing sustainable finance and investing, enhancing community green spaces through TD Friends of the Environment Foundation, and engaging with communities, colleagues, and customers on environment. Nicole has been instrumental in delivering key initiatives to strengthen TD's leading position in the environmental sector, including the issuance of the largest green bond by a Canadian bank at US$1 billion, the first commitment by a Canadian bank in support of the low carbon economy at CA$100 billion, the first green bond investment statement published among North American banks, and TD's 100% Renewable Energy Commitment.

-

NOAH BRITO

AVP, Decarbonization Strategy

Working with key business and risk partners within the bank, Noah leads the development of TD Scope 3 Financed Emissions targets and the continual evolution of sector-based transition strategies, enabling greenhouse gas reduction and adoption of clean techlogy. Over the past year, Noah has led the complex mandate of developing targets to align TD's financing portfolios to the global climate change goal of net zero emissions by 2050, delivering TD's first set of targets covering the Energy and Power sectors in 2022 and Automotive and Aviation in 2023. He established the new specialized group focused on decarbonization strategy tasked with calculating financed emissions for the bank, setting and managing interim emissions targets, and supporting businesses to deliver on TD's Climate Action Plan. Prior to joining TD, he obtained his MBA from Ivey Business School and worked as a Senior Engineer for SLB.

-

ANASTASTIA OSTAPCHUK

Winner CEF Leadership Program (2018)

Senior Manager, Sustainability Transition Strategy

Anastasia has been with TD Bank Group since 2014. Prior to her current role, she was a manager on the Corporate Environmental Affairs team at TD Bank Group and has held several roles contributing to the execution of TD’s Environmental and Corporate Citizenship Strategy, including managing the environmental reporting program, executing on TD’s carbon neutral commitment, and developing TD’s Green Bond Framework. Her most recent role is focused on managing environmental and social risks and opportunities. Prior to joining TD, Anastasia worked with a sustainability consultancy and the Canadian local network of the UN Global Compact.

-

JASON D. EVANS

Manager of Responsible Sourcing & Supplier Diversity

Jason recently joined TD Bank. Previously, Jason was the Supplier Diversity Specialist for Penn Procurement at the University of Pennsylvania, where his role was focused on Diversity and Economic Inclusion. For over 20 years, Jason has been an active community volunteer and leader with various organizations in Philadelphia, culminating with receiving the region’s prestigious 2022 Community Heroes Award. His humanitarian work includes serving as a board member of Philly AIDS Thrift as well as Philadelphia's LGBTQ+ Chamber of Commerce. He is also the former Co-Chair and inaugural member of the Mayor’s Commission on LGBT Affairs. Jason is a graduate of the University of Pennsylvania with Bachelor of Arts degrees in Sociology and Political Science, complimented by a Certificate in Law from Penn Law School. He is currently enrolled in the Fels School of Government at the University of Pennsylvania where he is working toward his Master’s Degree in Public Administration.

Latest Sustainability Reporting

(March 2025)

Highlights

- Reduced Scope 1 and 2 GHG emissions by 29% in 2024 (2019 baseline).

- Reduced financed emission lending intensity in the energy sector 16% in 2024,and physical emissions intensity in the power generation, automotive manufacturing and aviation sectors by 10%, 2%, and 2% respectively (2022 baselines).

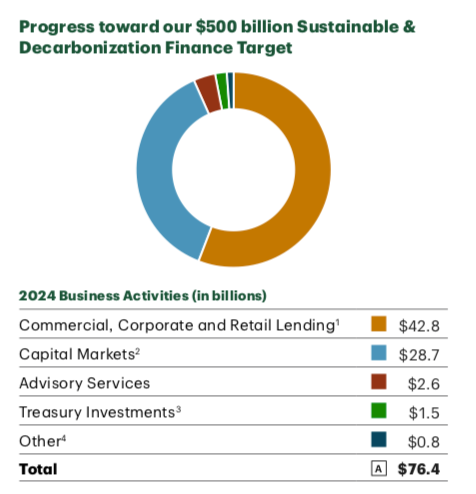

- Increased support to environmental, decarbonization and social activities to $145.9 billion through lending, financing, investing and other services in 2024, up from $69.5 billion in 2023.

- Invested $854 million in community giving, cumulatively since 2019, up from $685 million in 2023.

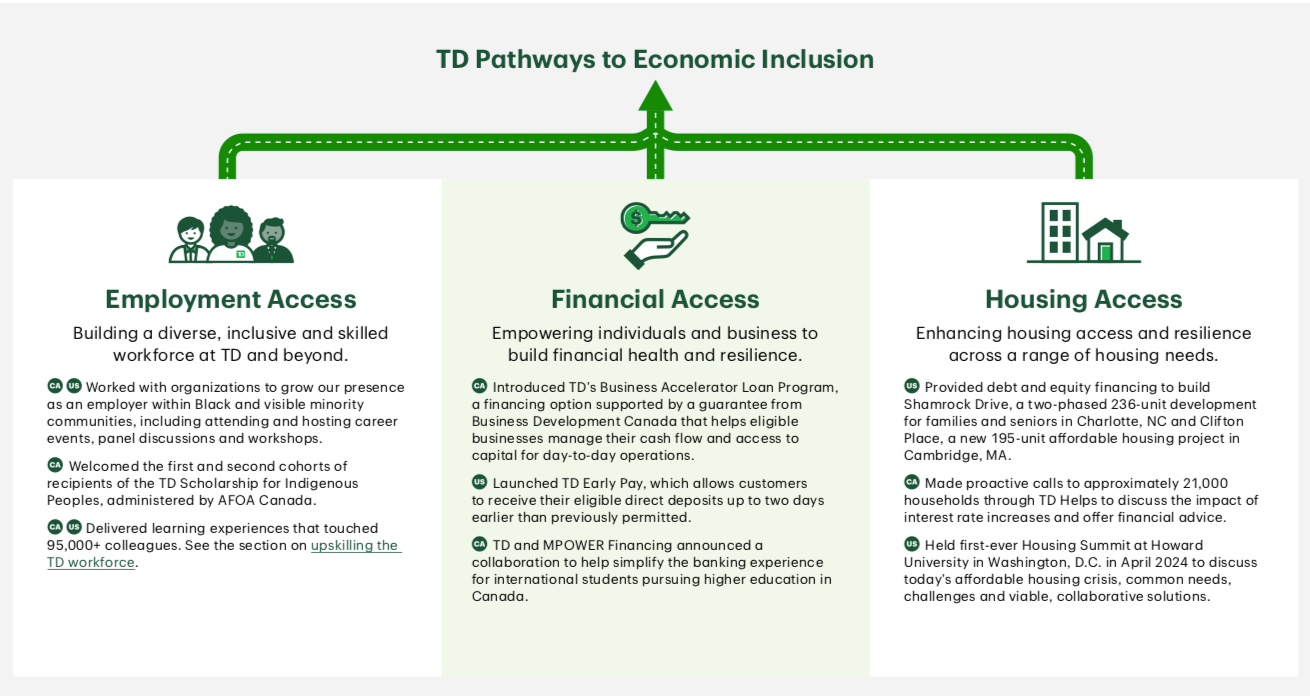

- Achieved its goal of reaching 500,000 participants through TD-led and supported financial education initiatives in Canada and the U.S. in 2024.

- Provided $5.9 billion in affordable housing financing in Canada and the U.S. (cumulatively since 2023).

- Increased the number of women in roles titled Vice President or above to 42.7% in 2024 from 41.6% in 2023.

- Increased the number of Black, Indigenous, and minority representation in roles titled Vice President or above to 25.7% in 2024, up from 24.3% in 2023.

Recent News

2026

TD BANK / CHARM INDUSTRIAL — Signed a 10-year carbon offtake agreement for TD Bank to purchase 44,000 tons of carbon removals from Charm, beginning in 2029. Charm will convert farming and forest residue into biochar (for storage in soils) and bio-oil (for sequestration deep underground). Charm also noted its plan to expand into Canada where it aims to harvest excess forest residues for pyrolization, reducing wildfire risks in the process. (Jan 2026)

2023

Announced new ESG and sustainable finance measures. This includes a new CAD$500 billion ($363.5 billion) Sustainable & Decarbonization Finance Target by 2030, and new Scope 3 financed emissions 2030 targets for two additional sectors: aviation (8% intensity reduction) and automotive manufacturing (a 50% “tank to wheel” intensity reduction), from a 2019 baseline. (March 2023)

2022

RUBICON CARBON — Launched as a new carbon credit platform to scale and provide easier access to high-integrity emissions reduction solutions by vetting projects and their credits. Rubicon received an initial capital commitment of $300 million from CEF member TPG, with a total capital commitment target of $1 billion. As part of its launch, Rubicon also formed a coalition of corporate sustainability leaders to help guide its platform and product development, including CEF members Bank of America, Dow, GE, Honeywell, J.P. Morgan, JetBlue, McKinsey & Co., and TD Bank. (Dec 2022)

Set new Paris-aligned targets for its financed emissions in the Energy sector and Power Generation sector. By 2030, the company is targeting a 29% reduction over a 2019 baseline in financed emissions for the Energy sector (including clients involved in thermal coal mining, low-carbon fuels and technologies, and the exploration, transportation, and refining of oil and gas) and a 58% reduction over 2019 in financed emissions for the Power Generation sector (including clients involved in the generation of power). Targets cover clients’ operational emissions (Scopes 1 and 2) and end-use Scope 3 emissions (i.e., emissions that result from the end-use combustion of fossil fuels). (March 2022)

2021

Climate Action 100+

—

The group of

615 investors managing $60 trillion in assets released a new

report through IIGCC detailing their expectations for electric utility companies’ net-zero transitions. They called on utilities to target

net-zero emissions by 2035 in developed countries and by 2040 in developing countries, as well as a minimum 50% emission reduction by 2030. They also expect companies to

commit to providing a “just” net-zero transition.

Climate Action 100+ investors include CEF members BlackRock, Fidelity Investments, J.P. Morgan Asset Management

(JPMorgan Chase & Co.’s asset management division), and

TD Asset Management

(of TD Bank Group).

(Oct 2021)

MORE »

TPG —

Announced a

first close of $5.4 billion for the TPG Rise Climate Fund, the largest climate-focused fund in the world. Over

20 global companies—including CEF members

3M, ADM,

Alphabet, Apple,

Bank of America, Boeing, Dow, GE, General Motors, Honeywell,

and

TD Bank Group—participated in the close and will form a

Rise Climate Coalition. The fund will take a broad sector approach, focusing on growth equity to value-added infrastructure to

driving solutions for 5 climate sub-sectors. (Aug 2021)

MORE »

RE100 — The RE100 companies, which are committed to 100% renewable electricity, now have an electricity demand greater than that of the U.K. or Italy and are on track to save CO2 emissions equal to burning over 118 million tons of coal per year. RE100 members include

CEF Members:

3M, Apple, Bank of America, Bloomberg, Dell Technologies, Ecolab, Facebook, General Motors, Google, Hewlett Packard Enterprise, HP Inc., Johnson & Johnson, JPMorgan Chase & Co., Mastercard, McKinsey & Co., Microsoft, Morgan Stanley, PepsiCo, Procter & Gamble, Siemens AG, TD Bank Group, Trane Technologies, Unilever,

and Visa.

(July 2021)

MORE »

2020

TD Bank Group issued a $500 million sustainability bond to “finance and/or refinance loans, investments and internal or external projects” that are considered to be environmentally or socially responsible under the bank’s Sustainable Bonds Framework. This is the Bank’s first-ever sustainability bond issuance. (October 2020)

TD Bank committed CDN$1 million to help front-line community health centers meet local needs, in collaboration with the Canadian Association of Community Health Centers and the U.S.-based National Association of Community Health Centers. (April 2020)