CEF Lead Executives

-

MARYANNE HANCOCK

Chief Executive Officer

Maryanne leads Y Analytics in its strategy, development, and growth. Previously, Maryanne spent 20 years at McKinsey and Company, where she was a Senior Partner. Among her several leadership roles, Maryanne co-founded McKinsey’s K-12 education practice in the U.S. and served several poverty alleviation non-profits, including CARE. Maryanne holds a BA with Honors and an MA in Foreign Affairs from the University of Virginia, and a JD magna cum laude from Harvard Law School.

-

RITU KUMAR

Senior Director

Ritu has deep expertise in environmental economics, with more than 25 years of global ESG and sustainability experience, including successful development and delivery of climate change initiatives, resource efficiency, value creation through enhanced ESG practices, compliance monitoring (including IFC Performance Standards), and private sector capacity building for managing ESG issues across emerging markets. Ritu has spent several years with the UN Industrial Development Organisation, the private equity firm Actis and the UK development finance institute (CDC Group) where she established and led the ESG function. She has served on the Board and investment committee of the Global Climate Partnership Fund, advisory board of Marks and Spencer as well as several ESG Committees of private companies. She has a master’s degree in economics from the London School of Economics and Delhi School of Economics.

-

LIZ STIVERSON

Managing Director, ESG

Liz leads TPG’s firm-and portfolio-level ESG strategy and programs at Y Analytics. Before joining Y Analytics, she spent seven years serving as Chief of Staff to TPG’s CEOs and Executive Office, and she also plays a founding leadership role in TPG NEXT, the firm’s initiative to seed, support and scale diverse investors and entrepreneurs. Prior to TPG, Liz worked for BCG, where her work included research and operational change for charter school networks and metropolitan school districts. She holds a BA with Honors from Yale University and an MBA from The Wharton School of the University of Pennsylvania.

-

SEMIRAY KASOOLU

Director, Impact Solutions

Semi’s background is in helping governments, international organizations, and investors translate evidence-based research into more effective economic policies and capital allocation decisions. Prior to joining Y Analytics, Semi was a Research Manager at the Growth Lab at the Center for International Development at Harvard University, where she managed research projects focused on achieving sustainable and inclusive growth in a number of countries. Her areas of research focus include labor market frictions and women’s economic inclusion in the Middle East. Semi holds a B.S. in Economics and Accounting from Saint Peter’s University and a MPA in International Development from the Harvard Kennedy School.

Sustainability Goals

Sustainability Goals

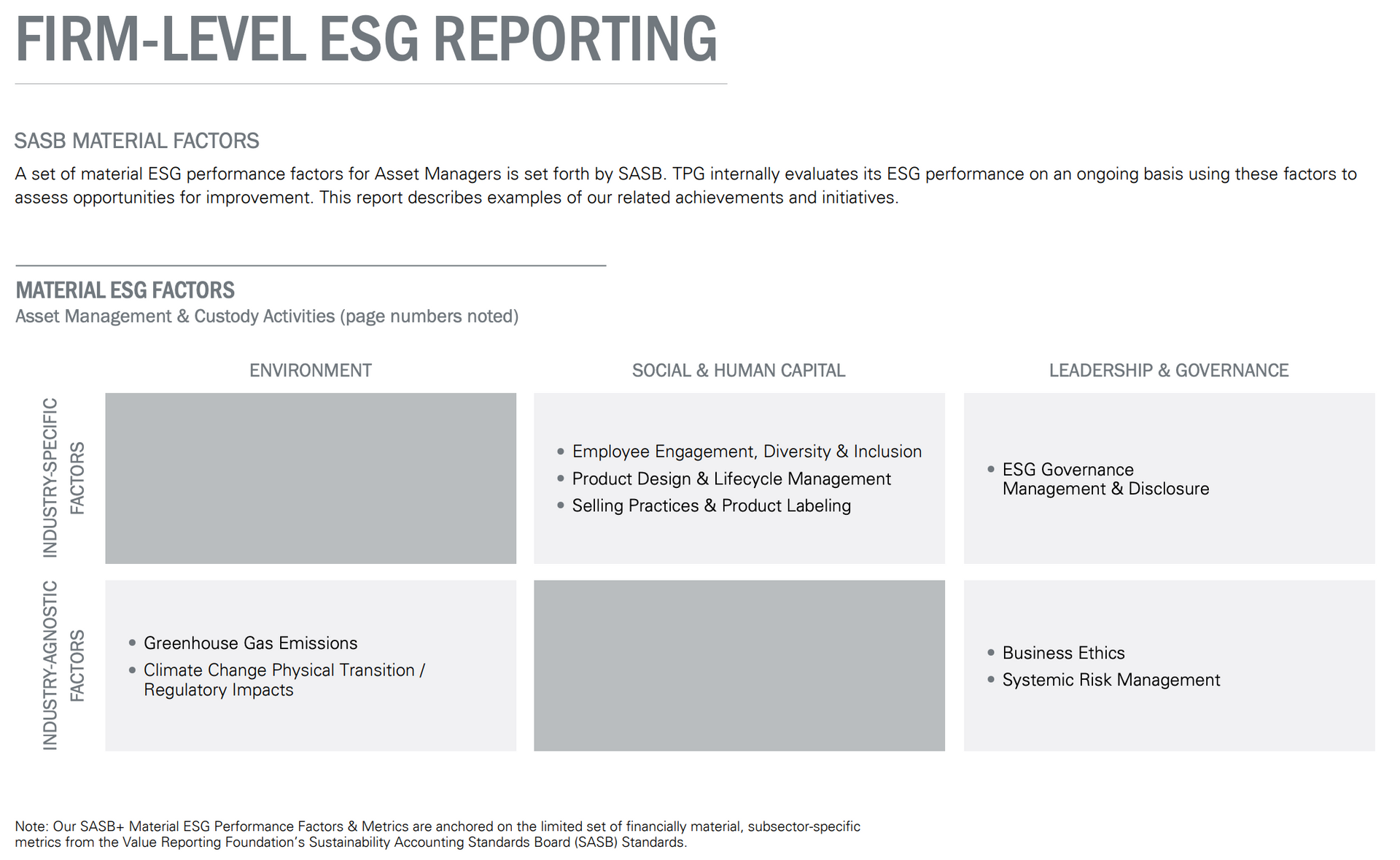

TPG Global ESG Performance Policy Commitments:

- Incorporate consideration of material ESG factors across our diligence and investment processes

- Advise and support our portfolio companies in managing ESG performance risks and pursuing value-

- creation opportunities

- Foster greater transparency related to the material ESG performance factors across the portfolio

Latest Sustainability Reporting

(October 2023)

Highlights

- 67% of private market investments are in ESG-related sectors.

- Conducted more than 200 Material ESG Factor performance screenings in the last three years for potential investments and portfolio companies.

- Produced quantitative assessments and benchmarks to guide ESG strategy development and value creation with more than 50 portfolio companies, and engaged with numerous other companies to provide specialized ESG research and best practice guidance to aid their ESG performance improvement efforts.

- Less than 1% of TPG’s global assets under management is directly invested in fossil fuel companies.

- 71% of portfolio companies took actions to reduce their carbon footprints in 2022 and 34% have or are working on a greenhouse gas emissions reduction target.

- 93% of portfolio companies track or are working toward tracking employee diversity and 67% hold workplace DEI trainings.

- 2022 operational emissions were 34% lower than 2019 emissions, including Scopes 1, 2, and 3.

- In 2022, made a preemptive purchase of high-quality credits equivalent to the company’s anticipated emissions for that year (not deducted from reported emissions).

- 75% of global new hires recruited in the first half of 2023 were racially or ethnically diverse in the U.S., gender diverse globally, or self-identify as LGBTQ+.

Recent News

2023

The UAE announced a $30 billion commitment to ALTÉRRA, a new climate vehicle with an emphasis on improving access to funding for the Global South. The funding makes ALTÉRRA the world’s largest private investment vehicle for climate change action. ALTÉRRA is also working with CEF members Blackrock and TPG, as well as Brookfield, to allocate the initial $6.5 billion in climate commitments. (Dec 2023)

Announced the launch of the inaugural TPG NEXT fund, which will back the next generation of underrepresented alternative asset managers. The fund is being anchored with a $500 million commitment from the California Public Employees’ Retirement System (CalPERS) and aims to increase the number of diverse-led firms in alternative assets, bringing the industry into closer alignment with broader demographic trends. (Jan 2023)

2022

RUBICON CARBON — Launched as a new carbon credit platform to scale and provide easier access to high-integrity emissions reduction solutions by vetting projects and their credits. Rubicon received an initial capital commitment of $300 million from CEF member TPG, with a total capital commitment target of $1 billion. As part of its launch, Rubicon also formed a coalition of corporate sustainability leaders to help guide its platform and product development, including CEF members Bank of America, Dow, GE, Honeywell, J.P. Morgan, JetBlue, McKinsey & Co., and TD Bank. (Dec 2022)

SUMMIT CARBON SOLUTIONS — Announced completion of equity fundraising efforts to support the development of its proposed carbon capture and storage project in the Upper Midwestern United States. The company has raised more than $1 billion, with $300 million coming from TPG Rise Climate, the climate investing arm of CEF member TPG Capital. The project, slated to be running in 2024, would capture waste greenhouse gases from ethanol and fertilizer plants in the Upper Midwest and transport them via pipeline to an underground injection site in North Dakota for permanent storage. Concurrently, Summit has been developing several carbon storage sites in North, Dakota, including an agreement with Minnkota Power Cooperative for access to their already-permitted 100-million-ton capacity storage site near Center, ND—the largest in the U.S. (May 2022)

Global alternative asset firm

TPG

announced the $7.3 billion final close of TPG Rise Climate, the dedicated climate investing strategy for TPG Rise, its global investing platform. Since its 2021 launch, TPG Rise Climate

has deployed capital through growth-stage investments in innovative climate solutions including investing in

Nextracker, a leading solar tracking company, backing the

merger of Bluesource and Element Markets to create North America’s largest marketer and originator of carbon and environmental credits, and

partnering with Tata Motors to catalyze the deployment of EVs

and necessary infrastructure in India. (May 2022)

MORE »

2021

The company’s $5.4 billion Rise Climate Fund has backed startup

Form Energy,

which is developing a rechargeable iron-air battery that is less than 1/10th the cost of lithium-ion, delivers 100 hours of electricity, and can be used continuously over multiple days.

(Aug 2021)

MORE »

Nearly 100 leaders of companies, associations, and organizations—including CEF members

Facebook, Microsoft, Apple, Hewlett Packard Enterprise, Amazon, Alphabet, General Motors, Mastercard, HP Inc., Cisco,

and

TPG —sent a letter urging Congress to pass legislation to create a pathway to citizenship for the “Dreamers”—who would benefit from the Deferred Action for Childhood Arrivals program. The leaders were organized by the

Coalition for the American Dream. (Aug 2021)

MORE »

Announced a

first close of $5.4 billion for the TPG Rise Climate Fund, the largest climate-focused fund in the world. Over

20 global companies—including CEF members

3M, ADM,

Alphabet, Apple,

Bank of America, Boeing, Dow, GE, General Motors, Honeywell,

and

TD Bank Group—participated in the close and will form a

Rise Climate Coalition. The fund will take a broad sector approach, focusing on growth equity to value-added infrastructure to

driving solutions for 5 climate sub-sectors. (Aug 2021)

MORE »

Invested $100 million in

Climavision, a new "weather services and intelligence platform” company to help businesses, governments, and communities manage the risks of extreme weather spurred by climate change.

The investment was made through TPG’s

"The Rise Fund." (June 2021)

MORE »

Climate Vault, a new nonprofit founded at the University of Chicago, launched to tackle the “credibility problems and opacity of voluntary offset programs.”

Leveraging government-regulated compliance (aka “cap-and-trade”) markets, the NGO will purchase and “vault” carbon permits to prevent major emitters from using them.

It will also

support and invest in emerging carbon removal technologies. Initial supporters—including

DRW, TPG,

and Vanderbilt University—helped the new nonprofit acquire and reduce over 200,000 metric tons of carbon from the marketplace upon its launch. (May 2021)

MORE »