CEF Lead Executives

-

AARON CHETHALANItem Link

Global Head of Corporate Sustainability

Aaron has been at BlackRock for 11 years. Previous roles include VP of External Affairs in the Corporate Sustainability function, VP Head of Strategy for Innovation Hub, Cheif of Staff to Chief Client Officer and Head of Americas Region, and a US Wealth Advisory Relationship Manager. Aaron has a B.S. in Business Administration and Management, Finance.

-

DANIELLE SUGARMANItem Link

VP, Investment Stewardship

Danielle Sugarman linkedin

Danielle is a Vice President with BlackRock’s Investment Stewardship team. She serves as the lead analyst in the Americas for the energy, utilities and pharmaceutical sectors. Her work includes engagement with executives and directors of BlackRock’s portfolio companies on corporate strategy, governance, environmental and social matters, M&A considerations, proxy contests and hostile takeover bids. She also votes BlackRock’s shares in Annual and Special meetings in relation thereto. Danielle has particular expertise in climate change, sustainability, and environmental and securities law.

-

JARED BOROCZ-COHENItem Link

CEFNext

Associate

Jared Borocz-Cohen is a member of the firm’s Americas Institutional Client Contracting Team, responsible for drafting and negotiating all investment contracts between BlackRock and its institutional investors. Jared’s team focuses on providing an exceptional client experience, while maintaining all regulatory, legal, and ethical requirements. Jared is the Atlanta lead for BlackRock’s Green Sustainability Network, and actively works to promote BlackRock’s sustainable agenda. Jared is a corporate attorney by trade, and prior to joining BlackRock, worked at numerous national law firms as a litigator, primarily focused on corporate disputes. Jared received his JD from the University of Miami School of Law and his BA from the University of Georgia.

Sustainability Goals

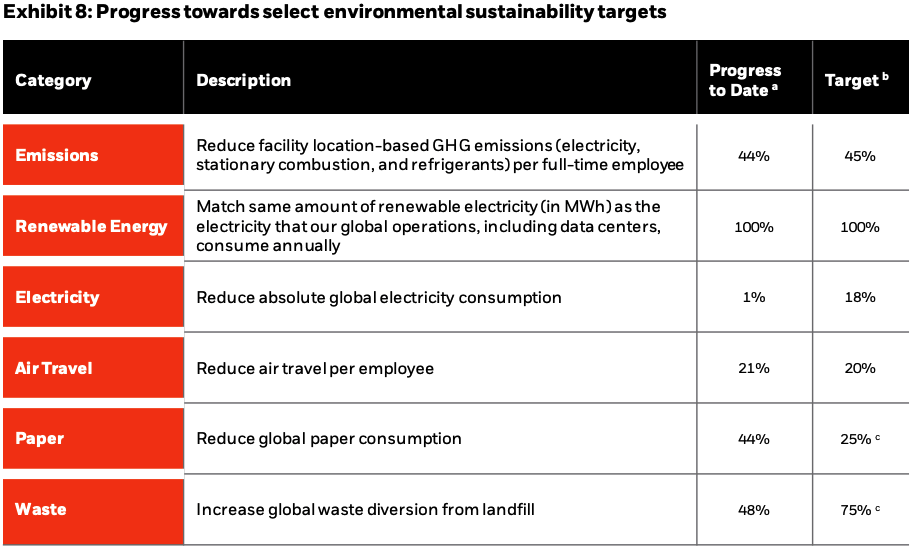

Outstanding Goals

- Reduce emissions per employee by 45%

- 100% renewable energy globally

- Reduce absolute global electricity consumption by 18%

- Reduce air travel per employee by 20%

- Reduce global paper consumption by 25%

- Increase global waste diversion from landfill by 75%

2024 Goals

- Pledged to increase the number of Black employees in its workforce by 30%

2050 Goals

- Invest in next-generation companies providing solutions and technologies to accelerate the global transition to net-zero

Recent Sustainability Reporting and Achievements

Highlights

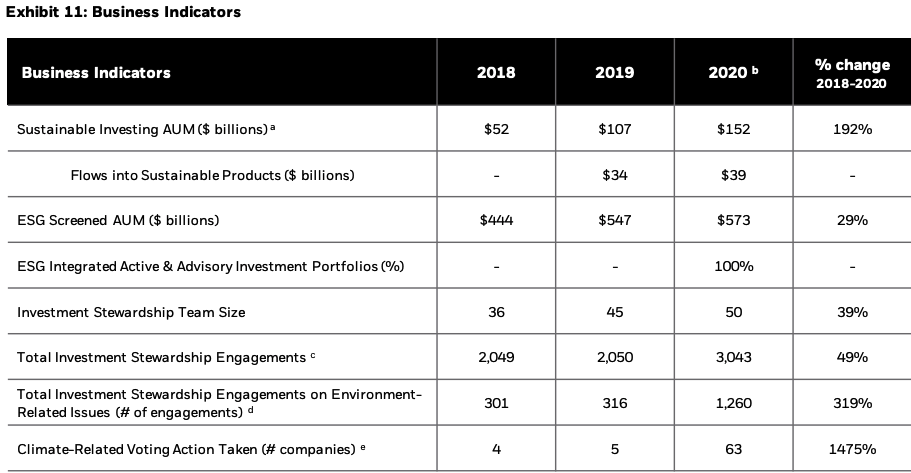

- Achieved ESG integration across 100% of its active portfolios and advisory strategies (covering $2.9 trillion in AUM) as of November 2020

- 29.7% of senior leaders and 42.7% of all employees are women

- 28% of senior leaders and 42.5% of all employees represent a racial or ethnic group

- Committed $50 million to COVID relief efforts and $10 million to combat racial inequities

- Became a participant of the UN Global Compact

- Managed $152 billion in sustainable investment strategies on behalf of clients in 2020

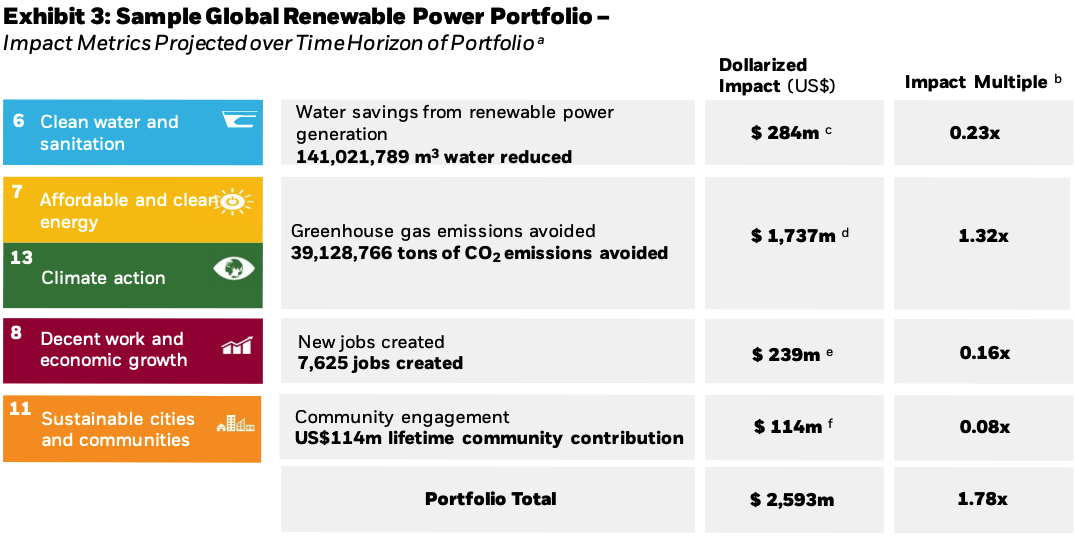

- Managed one of the world’s largest renewable power platforms in 2020, with more than $10 billion of current and future investments supporting over 270 wind and solar projects globally

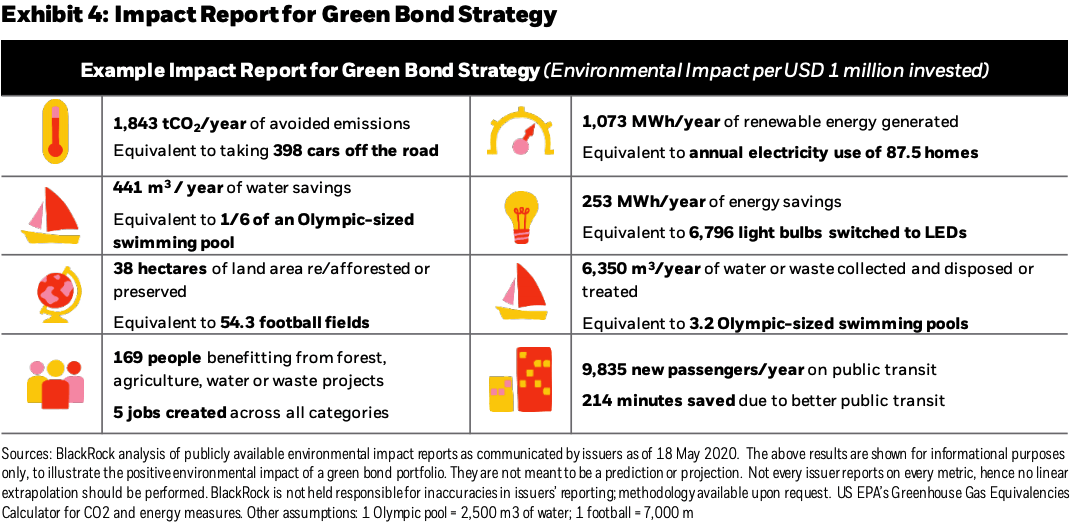

- Managed $21 billion in green bonds on behalf of clients in 2020

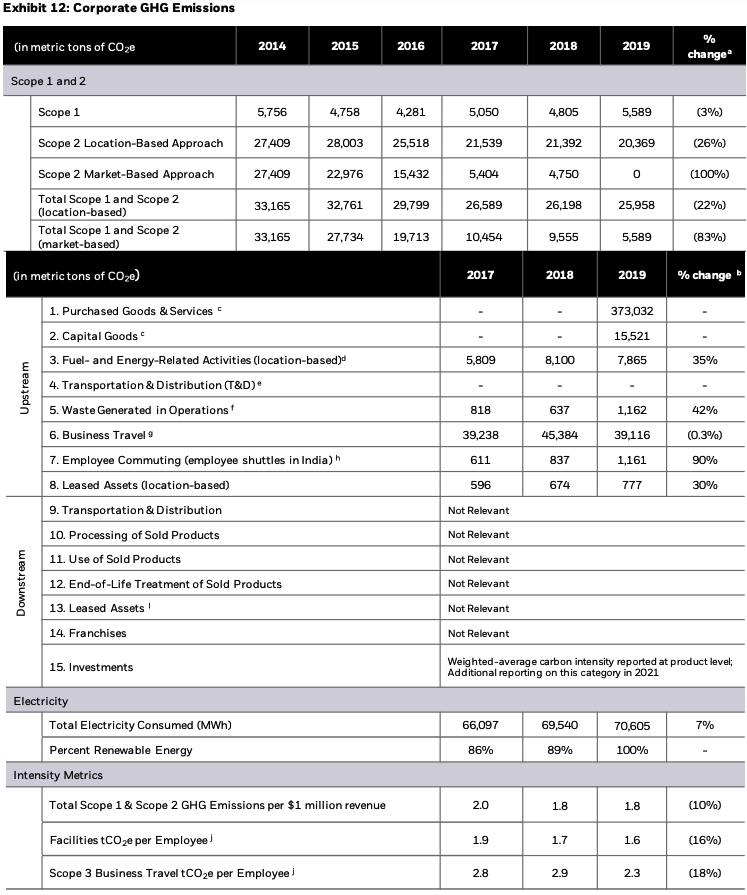

- Achieved carbon neutrality in its operations in 2020

- Ensured that 100% of active portfolios and advisory strategies were ESG integrated in 2020, meaning that portfolio managers are accountable for managing exposure to material ESG risks and documenting where in the investment process these risks are considered

- BlackRock Investment Stewardship took voting action for insufficient climate progress on 63 carbon-intensive companies, and placed an additional 191 companies “on watch”

- Sourced 100% of its electricity from renewables in 2020

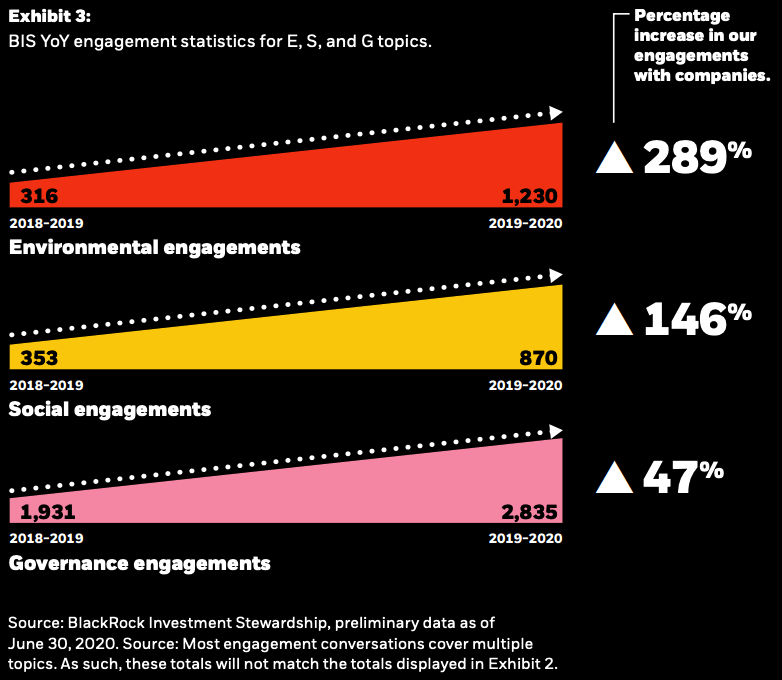

- Between July 2019 - June 2020,

engaged 640 companies on human capital management issues and an additional 125 on other social issues

Recent News

2024

Acquired infrastructure investor Global Infrastructure Partners (GIP) for $12.5 billion. GIP has over $100 billion in assets under management (AUM), with a focus on the energy, transportation, digital, water, and waste sectors. The merger will create a multi-asset class infrastructure investing platform with over $150 billion in AUM. (Jan 2024)

JPMORGAN CHASE / STATE STREET / BLACKROCK — The investment arms of JPMorgan Chase and State Street withdrew from the climate-focused investor network Climate Action 100+, while BlackRock transferred membership to its international arm, BlackRock International. These actions remove nearly $14 trillion of total assets from the coalition. (Feb 2024)

2023

The UAE announced a $30 billion commitment to ALTÉRRA, a new climate vehicle with an emphasis on improving access to funding for the Global South. The funding makes ALTÉRRA the world’s largest private investment vehicle for climate change action. ALTÉRRA is also working with CEF members Blackrock and TPG, as well as Brookfield, to allocate the initial $6.5 billion in climate commitments. (Dec 2023)

ABU DHABI GLOBAL MARKET (ADGM) —Launched the Global Climate Finance Centre (GCFC), which will accelerate the development of climate finance frameworks and champion best practices in the UAE and globally. The GCFC, an independent and private sector-focused global climate finance think tank, aims to address key barriers that hinder investment flows. GCFC's three core functions will be research, policy and innovation; advisory and stakeholder engagement; and capacity building through the Climate Finance Academy. Founding members include CEF member BlackRock. (Dec 2023)

BLACKROCK / OCCIDENTAL — BlackRock signed an agreement to form a joint venture with Occidental through its subsidiary 1PointFive to invest $550 million in the development of the STRATOS Direct Air Capture (DAC) facility in Texas. STRATOS is the largest planned DAC project in the world, designed to capture up to 500,000 metric tons of CO2/year, and is expected to be commercially operational in mid-2025. (Nov 2023)

Lifting financial performance by investing in women (BlackRock) — Companies with the most gender diverse workforces (i.e. neither under- nor over-representation by men or women) outperformed their country and industry group peers with the least diverse workforces by 1.6 percentage points per year on average between 2013 and 2022, based on data from roughly 1,250 MSCI World Index companies. The report found that where middle management best reflects women’s representation in the overall workforce the companies generated higher returns. However, gender diversity tends to deteriorate with seniority, with women being almost equally represented at entry level (49% to 51%); 33% at middle management; 18% at executive level; and just 6% at CEO level. Yet companies with a female CEO have “almost consistently outperformed” companies run by men over the past decade (by 1.0 percentage points on average). (Nov 2023)

BLACKROCK / SGX GROUP — Announced the launch of an exchange-traded fund (ETF) that offers investments in best-in-class companies committed to reducing carbon emissions. The iShares MSCI Asia ex-Japan Climate Action ETF launches with assets under management of $426 million, making it the largest-ever equity ETF launched in Singapore. (Sept 2023)

Is partnering with the government of New Zealand to launch a NZ$2 billion ($1.2 billion) net zero fund investing in the country’s renewable energy and climate infrastructure. New Zealand noted that this will support the country’s ambition to be the first country in the world to achieve the 100% renewable energy target (by 2030, up from its current 83%). According to BlackRock, this fund is the firm’s largest single country decarbonization-focused project to date. (Aug 2023)

Greenlane — Daimler Truck North America, NextEra Energy Resources, and BlackRock Alternatives launched this new joint venture to design, develop, install and operate a U.S.-wide, high-performance zero-emission public charging and hydrogen fueling network for medium- and heavy-duty battery-electric and hydrogen fuel cell vehicles. The companies have committed more than $650 million in funding and will develop this infrastructure along critical freight routes on the east and west coasts and in Texas. Greenlane’s first site will be in Southern California. (May 2023)

2022

Expanded its Voting Choice program, launched a year ago to make proxy voting easier and more accessible for eligible clients. $1.8 trillion of BlackRock’s total index equity of $3.8 trillion is now eligible for Voting Choice, with investors exercising Voting Choice for 25% of that ($452 billion). (Nov 2022)

Raised $4.5 billion in initial investor commitments for a new climate infrastructure fund. The fund seeks to invest in infrastructure assets and businesses globally to capitalize on three global energy transition trends: “decarbonization, decentralization, and digitalization.” (Oct 2022)

Created a new unit, Transition Capital, to invest in opportunities linked to the global shift to a low-carbon economy across asset classes and geographies. The unit will work with portfolio managers and BlackRock’s capital markets team to develop new investment strategies and funds and deepen the company’s research in the area. (Oct 2022)

Posted a new webpage, Energy investing: Setting the record straight, to respond to accusations that the company is “boycotting” oil and gas companies in pursuit of an ESG-focused social agenda. The webpage explains that BlackRock has invested $170 billion on behalf of clients in US public energy companies, including pipelines and power generation facilities. It also points out that the company’s focus on climate risk is in the interest of realizing the best long-term financial results for its clients. Finally, it notes that ultimately the choice of how clients invest lies with them through which investment products they choose. (Oct 2022)

Defended incorporating ESG factors into its investment decisions, writing to 19 Republican state attorneys general in a letter that climate change is a top concern for its clients and a key risk to consider in financial decisions. This is a response to the allegations by the attorneys general that the firm is pursuing a “climate agenda” at odds with generating investment returns. As BlackRock’s head of external affairs wrote in the letter, “Investors and companies that take a forward-looking position with respect to climate risk and its implications for the energy transition will generate better long-term financial outcomes.” (Sept 2022)

Announced it will establish a “perpetual infrastructure strategy,” designed to direct investments toward entities with high potential to accelerate the transition to a decarbonized economy. Of particular interest are utilities, renewable infrastructure players, data centers, grid management technologies, battery systems, and other “megatrends in energy transition and energy security.” Later this year, BlackRock will be seeking founding partners for the open-ended investment structures that will underpin the strategy. An estimated $125 trillion of investment is needed globally by 2050 to reach net zero, including over $4 trillion per year compared to $1 trillion per year currently. (June 2022)

The Net Zero Asset Managers initiative (NZAM) — An alliance of asset managers committed to achieving net-zero emissions across their entire portfolios by 2050. Since November, NZAM has added 53 new signatories for a total of 273, representing more than USD 61.3 trillion in assets under management. In that same time frame 43 signatories—including CEF member BlackRock—have disclosed the initial percentage of their portfolios that will be managed in alignment with net zero. The total number of signatories to have done so stands at 84, with 39% ($16 trillion) of their combined assets under management committed. (June 2022)

BLACKROCK / FORD / GOLDMAN SACHS / JPMORGAN CHASE / MORGAN STANLEY — Will disclose the race and gender of individual directors in deals reached with New York City (NYC) pension officials. The move is intended to demonstrate the companies’ alignment of hiring practices with their stated commitments on diversity and inclusion. Taking another view, NextEra Energy is urging its shareholders to vote against a resolution filed by the NYC pension funds for similar disclosures, noting by proxy statement that "The imposition of a prescriptive matrix by individual director can promote a check-the-box approach to refreshment, thus increasing the risk of bypassing a well-qualified candidate." The company already publishes details about the skills of individual directors, and infographics showing overall diversity statistics about the board. (May 2022)

Announced it has secured more than $800 million in initial commitments toward its $1 billion target for the BlackRock Impact Opportunities Fund. The fund will offer a first of its kind “multi-alternatives” strategy to invest in businesses and projects owned, led by, or serving people of color, with a particular focus on Black, Latinx, and Native American communities in the United States. The fund is designed to “do well and do good,” improving economic outcomes for undercapitalized communities of color and generating positive returns for investors. Three investments have been completed to date. (May 2022)

Issued commentary to investors related to 2022 climate-related shareholder proposals, sharing their observation that proposals this year were “more prescriptive or constraining on companies and may not promote long-term shareholder value” and that as a result Blackrock was likely to support proportionately fewer this proxy season than in 2021, when the firm supported 47% of environmental and social shareholder proposals. The guidance document further described Blackrock’s approach to dialogue with companies regarding the energy transition, reinforcing their view that climate risk is investment risk, and confirming they would be unlikely to support the re-election of directors considered to be falling short on climate risk oversight. (May 2022)

Projected that by 2030, at least 75% of its investments in corporate and sovereign assets will be invested in issuers with science-based emissions reduction targets or equivalent, compared to 25% today. (April 2022)

New analysis by Clarity AI, a sustainability data technology platform part-owned by CEF member BlackRock, shows that only 3.6% of revenues generated by a sample of 31,000 equity funds globally are “green” as defined in the EU taxonomy (revenues that contribute to climate change mitigation). The same report shows that only 7% of those funds have green revenues in excess of 10%. (March 2022)

BLACKROCK / MERCEDES-BENZ GROUP / NEXTERA ENERGY — Plan to collectively spend $650 million to build and operate an EV charging network for US truck routes in Texas and along the East and West Coasts by 2026. The companies will initially focus on electric medium- and heavy-duty vehicles, followed by hydrogen fueling stations for fuel-cell trucks and sites available for cars. (Feb 2022)

Pledged to expand the products and services it offers to help investors “navigate, drive, and invent” the net-zero transition, including (Feb 2022):

- Creating new funds and strategies to drive the transition, such as funding green technologies that haven’t yet reached scale.

- Launching more actively and passively managed products for clients to access “climate-aware” strategies.

- Creating a BlackRock Transition Scenario to show how the company expects the shift away from a fossil fuel economy will impact sectors, regions, and technologies.

- Adding climate benchmarks to its iShares strategies.

- Incorporating climate analytics into its consulting services.

LARRY FINK (BLACKROCK) — BlackRock Chairman and CEO Larry Fink published his annual letter to CEOs of public companies, warning that companies will be left behind if they don’t embrace sustainable business practices. He asserted that divesting from entire sectors, or moving money from carbon-intensive publicly traded assets to private ones, won’t help the world reach net zero. He also writes: “Workers demanding more from their employers is an essential feature of effective capitalism. … Companies not adjusting to this new reality and responding to their workers do so at their own peril.” (Jan 2022)

BLACKROCK — Is launching two funds that meet the EU’s demanding Sustainable Finance Disclosure Regulation (SFDR) Article 9 classification: (1) The Climate Action Multi-Asset Fund, which aims to deliver a lower carbon-intensity score than its benchmark and include a year-on-year decarbonization rate; (2) and The Climate Action Equity Fund, which aims to identify companies that are “long-term, disruptive structural winners” in reducing GHG emissions. (Jan 2022)

Breakthrough Energy’s Catalyst program launched an RFP to finance climate tech projects in the EU, Iceland, and Norway focused on four areas: direct air capture, long-duration energy storage, sustainable aviation fuel (SAF), and “green hydrogen” (hydrogen produced using renewable energy). It is the next phase of the EU-Catalyst partnership, which aims to mobilize up to $1 billion from 2022-2027 for technologies that deliver on the European Green Deal goals and the EU’s 2030 climate targets. Catalyst “anchor partners” include CEF members Bank of America, BlackRock, General Motors, and Microsoft. (Jan 2022)

2021

Released its 2022 Investment Stewardship Policy Updates Summary, which emphasizes board diversity targets and climate risk disclosure for portfolio companies. For U.S. companies, boards should aspire for 30% diversity, including at least two female directors and one representing an underrepresented group. It will continue to push companies to disclose a net-zero-aligned business plan, including how their plans would be resilient amid global efforts to limit planetary warming to 1.5 °C. (Dec 2021)

Breakthrough Energy’s Catalyst program (BEC) launched its first RFPs to finance climate tech projects focused on four areas: direct air capture, long-duration energy storage, sustainable aviation fuel (SAF), and “green hydrogen” (hydrogen produced using renewable energy to split water into hydrogen and oxygen). BEC aims to deploy $3 billion of funding over six years to projects in the U.S. and US territories, starting in 2022. Catalyst “anchor partners” include CEF members Bank of America, BlackRock, General Motors, and Microsoft. (Dec 2021)

Impact Management Platform — Global providers of sustainability standards and guidance formed a new collaboration “to mainstream the practice of impact management.” It is the next phase of a five-year, global collaboration facilitated by the Impact Management Project (IMP). The Platform’s Steering Committee will advise the new International Sustainability Standards Board, and Platform partners will work to “consolidate existing sustainability resources, collectively address gaps, and coordinate with policymakers and regulators.” IMP advisors include CEF members Bank of America and BlackRock, and IMP Practitioners include CEF member Oracle. Founding Platform partners: standards organizations (including GRI), NGOs (including CDP), UN initiatives (including the UN Global Compact), multilateral organizations (including the OECD), and groups such as Principles for Responsible Investment (including CEF member Bloomberg L.P.), the Capitals Coalition (including CEF members Dow, TD Bank, and Unilever), and the Global Impact Investing Network (including CEF members Bank of America, JPMorgan Chase & Co., and Morgan Stanley). (Nov 2021)

Key findings from BlackRock’s annual Global Insurance Report, which consulted insurance firms representing $27 trillion in investable assets across 26 markets (Nov 2021):

- 95% of insurers believe climate risk will significantly impact portfolio construction over the next two years

- 60% expect to increase their investment risk exposure over the next two years

- 42% have turned down an investment opportunity in the past 12 months because of ESG concerns

- 41% plan to boost investment in technology that integrates climate risk and metrics

LEAF Coalition —

The public-private partnership has

met its goal of mobilizing $1 billion for countries and states committed to increasing ambition to protect tropical forests. CEF member companies

Amazon, BlackRock, McKinsey,

and Unilever are among the coalition’s participants. (Nov 2021)

MORE »

Raised $673 million for the

Climate Finance Partnership, an

infrastructure fund created to mobilize capital for

climate-focused projects in emerging markets. Funds were raised by a public-private group of 22 investors including the French, German, and Japanese governments; NGOs; and companies such as

AXA

and TotalEnergies.

(Nov 2021)

MORE »

MORE 2 »

Announced it has

created the largest range of climate-aligned exchange-traded equity funds (ETFs)—the

iShares MSCI ESG Enhanced UCITS ETF range—by tightening the rules governing 6 existing ETFs with $9 billion in assets.

(Nov 2021)

MORE »

The British government

is forming a strategic partnership with Breakthrough Energy’s

Catalyst program to drive

private-sector investment in UK climate tech projects

and

accelerate the U.K.'s net-zero transition. The

government

committed at least $276 million for projects in Catalyst’s areas of focus (green hydrogen, direct air capture, long-duration energy storage, and sustainable aviation fuel), which will be matched by

Catalyst’s investor and business partners over 10 years.

Catalyst “anchor partners” include CEF members Bank of America, BlackRock, General Motors,

and Microsoft.

(Oct 2021)

MORE »

Climate Action 100+ —

The group of

615 investors managing $60 trillion in assets released a new

report through IIGCC detailing their expectations for electric utility companies’ net-zero transitions. They called on utilities to target

net-zero emissions by 2035 in developed countries and by 2040 in developing countries, as well as a minimum 50% emission reduction by 2030. They also expect companies to

commit to providing a “just” net-zero transition.

Climate Action 100+ investors include CEF members BlackRock, Fidelity Investments, J.P. Morgan Asset Management

(JPMorgan Chase & Co.’s asset management division), and

TD Asset Management

(of TD Bank Group).

(Oct 2021)

MORE »

Transition Pathway Initiative

(TPI) —

The global group of

113 investors with $40 trillion of assets under management plans to open a

new TPI Global Climate Transition Centre in early 2022 to

help investors align their portfolios with net-zero targets. The center will conduct

independent assessments of 10,000 companies—up from 400 today—and provide

free, public data on their net-zero transitions, with a focus on

3 major asset classes. TPI supporters include CEF member

BlackRock.

(Oct 2021)

MORE »

MORE 2 »

Released new

research saying that

active investors using emerging sustainability data and research can increasingly identify potential opportunities to “outperform” the broader market.

(Oct 2021)

MORE »

Measuring Portfolio Alignment: Technical Considerations

(Portfolio Alignment Team)

—

Outlines

emerging best practices for the development and use of “portfolio alignment tools,” which aim

to help investors measure financial portfolios’ alignment with Paris Agreement objectives. Identifies

priorities for future research to enable an “environment” for such tools. The Portfolio Alignment Team was convened in 2020 by

GFANZ Chair Mark Carney and includes executives from CEF members

Bank of America, BlackRock,

and

McKinsey & Co.

(Oct 2021)

MORE »

Emerging markets need at least $1 trillion of public and private financing per year to reach net-zero emissions by 2050—over 6 times current investment, according to a new

BlackRock

report. (Oct 2021)

MORE »

MORE 2 »

The Taskforce for Nature-related Financial Disclosures (TNFD) appointed 30 senior executives

from financial institutions, corporations, and service providers

to the

TNFD Taskforce. Members will

form 5 Working Groups to drive the development of a

beta disclosure framework to be launched in early 2022. TNFD Taskforce members include executives from CEF members

Bank of America

and BlackRock.

TNFD also launched the

TNFD Forum, a consultative group with over 100 institutions to support the Taskforce that includes CEF Member

Wells Fargo Asset Management. (Oct 2021)

MORE »

A group of 7 private companies collectively committed

over $1 billion as the new “anchor partners” for Breakthrough Energy’s

Catalyst program

(introduced in July), a

public-private sector partnership

to accelerate the commercial viability of climate technologies, with an initial

focus on 4 areas: green hydrogen, direct air capture, long-duration energy storage, and sustainable aviation fuel (SAF). The companies—including CEF members

Bank of America, BlackRock, General Motors,

and Microsoft,

as well as

American Airlines, ArcelorMittal SA, and

Boston Consulting Group—launched a

Request for Information and, as “anchor partners,” will invest in early-commercial demonstration projects and provide insights on investment and offtake strategies. (Sept 2021)

MORE »

MORE 2 »

MORE 3 »

Taskforce on Scaling Voluntary Carbon Markets (TSVCM) — The taskforce has formed an

independent Board of Directors to govern voluntary carbon markets, with

22 members

representing 12 countries (40% in the Global South); the NGO, academic, corporate, and financial sectors; Indigenous people; and local communities.

The Board will be supported by TSVCM’s founding sponsors, an Executive Secretariat, an Expert Panel, a Senior Advisory Council, and a

Member

consultation group of 250 organizations (including CEF members

Bank of America, BlackRock, BloombergNEF, Bloomberg Philanthropies, Boeing, Chevron, Delta, Google, JPMorgan Chase & Co., Microsoft, Morgan Stanley, Siemens,

and Unilever). (Sept 2021)

MORE »

MORE 2 »

32 companies that have prioritized their workers during the COVID-19 pandemic

(e.g., by establishing safety practices, disclosing demographic details to drive racial equity, worker benefits)

have outperformed companies on the Russell 1000 by 8.6%, according to a JUST Capital

ranking of companies “leading for their workers” by industry. CEF members

BlackRock, Chevron, Comcast, Dow, Ford, JPMorgan Chase & Co., Lockheed Martin, McKesson,

and Procter & Gamble are among the 32 companies featured. (Sept 2021)

MORE »

Climate Action 100+

— The group of 617 global investors managing over $55 trillion in assets

released a

set of expectations

laying out necessary actions for the food and beverage sector to achieve net-zero emissions in line with the Paris Agreement goals. Climate Action 100+ investors include CEF members BlackRock, Fidelity Investments, J.P. Morgan Asset Management,

and

Wells Fargo Asset Management.

(Aug 2021)

MORE »

Climate Action 100+ — A group of 545 global investors managing over $52 trillion in assets released a sector strategy with key expectations for steel producers and other steel value chain stakeholders to align with Paris Agreement decarbonization goals. The strategy was published by the Institutional Investors Group on Climate Change (IIGCC). Climate Action 100+ investors include CEF members BlackRock, Fidelity Investments,

and

J.P. Morgan Asset Management.

(Aug 2021)

MORE »

Shared in its quarterly stewardship report that it

voted against almost 5 times more company board directors during the proxy season that ended June 30 than the year before because the directors failed to act on climate issues. The company also didn’t support the management of 319 companies for climate-related reasons (up from 53 in 2020) and voted against the reelection of 1,862 directors at 975 companies due to lack of board diversity. (July 2021)

MORE »

CEO Larry Fink, speaking to the G20 Venice International Conference on Climate,

called for governments to strengthen long-term climate finance plans to unlock private capital for the transition to a low-carbon economy. Fink proposed reforming the IMF and World Bank so they’re more suited to tackle climate change, support private firms’ execution of sustainability disclosures, and increase investment to lower the “green premium.” (July 2021)

MORE »

Taskforce on Scaling Voluntary Carbon Markets — The private sector-led initiative

published a new roadmap with next steps for creating a high-integrity, scaled, voluntary market for carbon credit trading. The taskforce—whose members include

Bank of America, BlackRock, Bloomberg NEF,

and Siemens—will recruit an independent body to govern the market. (July 2021)

MORE »

Net Zero Asset Managers initiative

— The global group of asset managers has

41 new signatories for a total of 128 managing $43 trillion, almost half the global asset management sector. Founded in December 2020 by 6 investor networks, including

Ceres, CDP,

and

Principles for Responsible Investment, signatories include

BlackRock, Fidelity International, and Vanguard.

(July 2021)

MORE »

Raised $250 million of $500 million targeted for its

Climate Finance Partnership to invest in climate infrastructure in select Asian, African, and Latin American countries. The partnership’s 10 investors included the governments of France, Germany, Japan, and other philanthropies and institutional investors. (July 2021)

MORE »

Will acquire London-based consulting firm

Baringa Partners'

climate modeling system

to blend the model with BlackRock’s Aladdin Climate tools and expand its capacity to minimize climate risk exposure in client portfolios. (June 2021)

MORE »

BlackRock Chairman and CEO Larry Fink and Deutsche Bank CEO Christian Sewing denounced public companies divesting dirty businesses to achieve climate ambitions.

"It just goes from a transparent organization to an opaque organization, that is not going to get us to where we want to go as a society,” said Fink. (June 2021)

MORE »

Hundreds of executives, nonprofits, and companies—including Amazon, Apple, Bank of America, BlackRock, Cisco, Dell Technologies, Facebook, Ford, General Motors, Google, JetBlue, Johnson & Johnson, Mastercard, and McKinsey & Co.—signed a public statement opposing “any discriminatory legislation.” The statement, titled “We Stand for Democracy,” was featured in advertisements in the New York Times and The Washington Post. (April 2021)

Announced “Decarbonization Partners,” a new investment firm in partnership with Temasek to invest in next-generation companies providing solutions and technologies to accelerate the global transition to net-zero by 2050. The companies committed to allocating a total of $600 million to the effort and plan to launch a series of late-stage venture capital and early growth private equity investment funds, including a target of$1 billion funding for its first fund. (April 2021)

Member companies of the Partnership for Renewable Energy Finance (PREF)—including Amazon, Bank of America, BlackRock, Google, JPMorgan, Morgan Stanley, and Wells Fargo—sent a letter to Texas officials opposing 3 energy-related bills, fearing they will upend the economics of wind and solar power in the state. (April 2021)

Chairman and CEO Larry Fink, in a letter to BlackRock’s shareholders, called for mandatory disclosure requirements for both private and public companies, coupled with legal protections for companies doing their best at describing risks. "If large private companies are not held to the same level of scrutiny as public companies, we will create an unintended incentive to shift carbon-intensive assets to markets with less transparency and, often, less regulation," Fink wrote. (April 2021)

Announced a $4.4 billion ESG-linked credit facility tied to 3 ESG metrics: (1) Women's representation in senior roles, (2) Black and Latino employment, and (3) Total investment in assets benefiting society and the environment. The interest rate and fee it pays lenders on any amounts drawn from the credit facility will rise or fall annually from 2022, depending on the number of targets it meets. (April 2021)

Raised $4.8 billion from over 100 institutional investors for its 3rd Global Renewable Power Fund, almost doubling its initial target of $2.5 billion. It is the largest renewable power fund to date for BlackRock Real Assets, nearly triple its previous fund size. (April 2021)

Announced plans to undergo an independent racial audit of its operations in 2022 to determine how it may have contributed to racial inequities in the financial system, following a request from shareholders. (April 2021)

Companies across the country—including Apple, BlackRock, Bank of America, Cisco, Facebook, JPMorgan Chase, Microsoft, and UPS—denounced the state of Georgia’s new law overhauling state election procedures over concerns it will restrict voter access and disproportionately disenfranchise people of color. Dozens of Black executives have called on companies to stand up for racial justice by fighting a wave of similar restrictive voting bills being advanced by Republicans in at least 43 states. (April 2021)

Multiple Reports: Investment and Fiduciary Analysis for Potential Fossil Fuel Divestment

(BlackRock and Meketa) — Reviews the divestment strategies of 3 New York City pension funds from fossil fuel funds, including New York City Employees Retirement System, the Teachers Retirement System, and the Board of Education Retirement System (BERS).

Concludes, in 6 separate reports, investment funds had not experienced negative financial impacts from divestment of fossil fuels but rather earned moderate improvements in returns.

(March 2021)

Economic think tank AIF Institute launched the Center for ESG and Sustainable Investing to “address investor community priorities and provide actionable research” on climate, governance, and diversity through the lens of risk management and investment opportunity. Founding “Faculty Board” members include BlackRock and Natixis Investment Managers. (March 2021)

Announced a partnership to develop an industrial scale carbon capture pipeline system with Valero and midstream services company Navigator Energy Services. The initial phase is expected to span more than 1,200 miles across 5 Midwest states with the capability of transporting and permanently storing up to 5 million metric tons of carbon dioxide annually. (March 2021)

Released new guidelines indicating plans to vote against the re-election of directors if companies had not effectively managed or disclosed risks related to the depletion of “natural capital.” (March 2021)

Over 170 CEOs from U.S. companies issued a public letter to Congress backing President Biden’s $1.9 trillion coronavirus relief package and urged rapid, bipartisan adoption. CEF member companies involved included BlackRock, Comcast, Google, JetBlue, Mastercard, Morgan Stanley, Siemens, and Visa. (March 2021)

BlackRock released a detailed list of expectations for how companies should address climate risk, noting it may vote against directors if a company has not provided a “credible plan to transition its business model to a low-carbon economy.” (February 2021)

BlackRock Chairman and CEO Larry Fink published his 2021 letter to CEOs of public companies and reaffirmed the company’s stance that “climate risk is investment risk” and that “the climate transition presents a historic investment opportunity.” Fink made several requests of companies, including “to disclose a plan for how their business model will be compatible with a net-zero economy.” BlackRock also committed to help clients “prepare their portfolios for a net zero world” and outlined a series of concrete actions it will take in 2021 in the areas of transparency, investment management and investment stewardship. (January 2021)

The Taskforce on Scaling Voluntary Carbon Markets sponsored by the Institute of International Finance established core carbon market principles and released a roadmap of 20 comprehensive actions to scale the carbon offset market. The taskforce includes governments, NGOs, and businesses, including Bank of America, BlackRock, BloombergNEF, Boeing, Siemens, and Unilever. (January 2021)

The World Economic Forum

launched Partnering for Racial Justice in Business Initiative, a new coalition to build more equitable and just workplaces. Three steps required to join the initiative include: 1)

Racial and ethnic equity must be placed

on the board’s agenda; 2) Companies must

make at least one commitment towards racial and ethnic justice in their organizations; 3) Companies must put a

long-term strategy in place towards

becoming an anti-racist organization. Founding members include

Bank of America, BlackRock, Bloomberg, Cisco Systems, Facebook, Google, HP, Johnson & Johnson, Kaiser Permanente, Mastercard, McKinsey & Company, Microsoft, PepsiCo, Procter & Gamble, Unilever,

and UPS.

(January 2021)

MORE

»

HRH The Prince of Wales announced a “Terra Carta” (Earth Charter) outlining nearly 100 actions for businesses that form the “basis of a recovery plan to 2030 that puts Nature, People, and Planet at the heart of global value creation.” Released by the Prince’s Sustainable Markets Initiative, the Charter was signed by CEOs from AstraZeneca, Bank of America, Blackrock, BP, Fidelity International, HSBC, State Street, Unilever, among others. (January 2021)

2020

BlackRock published a paper calling for a “convergence of the different private sector reporting frameworks and standards to establish a globally recognized and adopted approach to sustainability reporting.” (November 2020)

BlackRock announced that its circular economy investment fund has raised $900 million since its launch last year. The fund was launched in partnership with the Ellen MacArthur Foundation. (October 2020)

BlackRock was ranked #5 on Fortune’s 2020 Change the World list, which recognizes companies that are driving positive social impact as part of their core business strategy. (September 2020)

BlackRock pledged to increase the number of Black employees in its workforce by 30% by 2024. (July 2020)

BlackRock Chairman and CEO Larry Fink published his annual letter to shareholders. In the letter, Larry Fink stated that the economy will recover steadily from the pandemic and highlighted that “companies and investors with a strong sense of purpose and a long-term approach will be better able to navigate this crisis and its aftermath.” (April 2020)

Committed $50 million to support people and programs on the frontlines of the COVID-19 response, as well as the most financially vulnerable individuals globally. The company deployed its first $18 million in funding to food banks and community organizations across America and Europe. (March, 2020)

Released its Engagement Priorities for 2020, which outline the firm’s roadmap for investment stewardship this year. The company’s five priorities include: board quality, environmental risks and opportunities, corporate strategy and capital allocation, compensation to promote long-termism, and human capital management. (March 2020)

BlackRock Chairman and CEO Larry Fink published his 2020 letter to CEOs of public companies, which outlines the firm’s new initiatives to place sustainability at the center of its investment approach. The firm’s new initiatives include: making sustainability integral to portfolio construction and risk management; exiting investments that present a high sustainability-related risk, such as thermal coal producers; launching new investment products that screen fossil fuels; and strengthening commitment to sustainability and transparency in investment stewardship activities. (January 2020)

Joined Climate Action 100+, an investor initiative aimed at engaging more than 100 of the world’s largest corporate GHG emitters to improve governance on climate change, curb emissions, and strengthen climate-related financial disclosures. The group includes more than 370 institutional investors, representing around $41 trillion in assets. (January 2020)

2019

Published “Megatrends: The Forces Shaping Our Future” (BlackRock, August 2019), laying out five megatrends that will shift the future global economy. The five megatrends include the following:

- Technological breakthrough

- Demographics and social change

- Rapid urbanization

- Climate change and resource scarcity

- Emerging global wealth

Launched its first fund dedicated to investing in businesses already contributing to or benefiting from the transition to a circular economy. The fund was launched as part of a global partnership with the Ellen MacArthur Foundation. (Oct 2019)

How can we help? Please reach out to us!

Laura Keenan, Chair

laura@corporateecoforum.com | (617) 921-2307

Amy O’Meara, Executive Director

amy@corporateecoforum.com | (857) 222-8270

Mike Rama, Deputy Director

mike@corporateecoforum.com | (607) 287-9236

Margaret Fenwick, Program Lead

margaret@corporateecoforum.com I (917) 678-4161

MR Rangaswami, Founder