Sustainability Goals

“Our goal is to become the world’s most sustainable and responsible bank and the leading private sector catalyser of finance for the UN Sustainable Development Goals (SDGs) where it matters most – in Asia, Africa and the Middle East.”

2022 goals

- Offset all residual emissions from our operations (Scope 1 and 2, Scope 3 flights, waste and data centres), doubling our average cost from $7.65 in 2021 to $15 per ton.

- Expect all clients in the power generation, mining and metals, and oil and gas sectors to have a decarbonization transition strategy in line with the goals of the Paris Agreement.

- Measure, manage and reduce emissions associated with our financing via the implementation of our net zero roadmap.

- Embed an integrated health and wellbeing strategy to support building and re-skilling a future-ready, diverse workforce.

- Support at least 50% of all employees to complete our learning programme on Sustainability.

- Support at least 70% of relevant employees to complete our Sustainable Finance training programme.

2023 goals

- Achieve and maintain flight emissions 28% lower than our 2019 baseline of 94,000 tons.

- Launch and grow green mortgages in key markets across our footprint.

- Measure and report mortgage emissions with a view to setting targets.

2024 goals

- Provide $15bn of financing to small business clients (Business Banking).

- Provide $3bn of financing to microfinance institutions.

- Grow our employee MyVoice score to the question “the way that we operate day-to-day is aligned with our vision of being the world’s most sustainable and responsible bank” from 2021 baseline of 84% to 88%.

2025 goals

- Reduce annual Scope 1 & 2 greenhouse gas emissions to net zero.

- Source all energy from renewable sources.

- Reduce waste per colleague to 40kg per year.

- Recycle 90% of waste.

- Integrate ESG considerations in wealth management advisory activities.

- Double Sustainable Investing Assets Under Management across a holistic proposition including Mutual Funds, Exchange Traded Funds (ETFs), Bonds, Equities, Structured Products, Discretionary Portfolio Mandates (DPMs) and Insurance Linked Plans (ILPs).

- Create Diversity & Inclusion Supplier Plans for all our markets to support 40% of our newly onboarded suppliers being diverse.

- Increase gender representation to 35% women in senior roles.

- Increase our ‘Culture of Inclusion’ score to 84.5%.

2030 goals

- Achieve emissions reduction in our most carbon-intensive sectors of:

- 63% in Power (Scopes 1 and 2 intensity);

- 33% in Steel Producers (Scopes 1 and 2 intensity);

- 33% in Mining (ex Coal) (Scopes 1 and 2 intensity);

- 30% in Oil and Gas (Scopes 1, 2 and 3 intensity) and;

- 85% emissions reduction in coal mining (Scopes 1, 2 and 3 absolute).

- Only provide financial services to clients who are less than 5% dependent on thermal coal (based on % revenue).

- By 2024, less than 80% dependent on thermal coal (based on % revenue);

- By 2025, are less than 60% dependent on thermal coal (based on % revenue);

- By 2027, are less than 40% dependent on thermal coal (based on % revenue);

- Mobilize $300bn aligned to our Green and Sustainable Product Framework and Transition Finance Framework

2032 goals

- End all direct coal financing for clients.

2050 goals

- Achieve net-zero carbon emissions from our financing portfolio.

Latest Sustainability Reporting

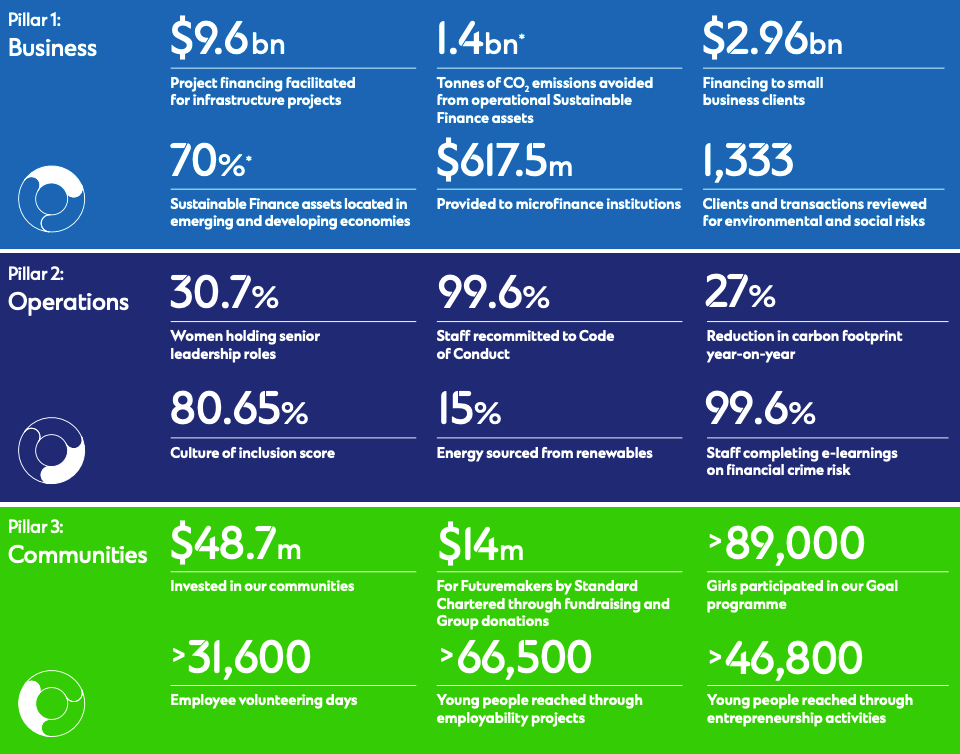

Highlights

- Achieved or on track for 82.9% of its sustainability aspirations.

- Reduced carbon footprint 27% from 2020.

- Sourced 15% of energy from renewables.

- Increased its Sustainable Finance asset base 138% year-on-year to $9.2 billion, with over 70% of assets located in emerging and developing economies.

- Avoided 1.4 billon tons of CO2 emissions from green lending practices, an increase of 264% from 2020.

- Reviewed 1,333 clients and transactions for environmental and social risks

- Increased women in senior leadership roles to 30.7%.

Recent News

2023

Announced a new 2030 target to reduce absolute financed emissions for the oil and gas sector by 29%, equivalent to 3.8 MTCO2e, from a 2020 baseline of 13.1 MTCO2e. The target aligns with the International Energy Agency Net Zero Emissions (IEA NZE) scenario and is consistent with the Paris Climate Agreement goal of limiting temperature rises to within 1.5º C. (May 2023)

2022

Sustainable Banking Report (Standard Chartered) — Analyses sustainable investing interests and apprehensions of over 3,000 individuals across 10 markets. (September 2022)

Six top lenders to the global steel sector — Citi, Crédit Agricole CIB, ING, Societe Generale, Standard Chartered and UniCredit — signed the Sustainable STEEL Principles (SSP), a Climate-Aligned Finance agreement for lenders to the steel industry, convened by RMI. The principles provide a methodology for banks to measure and report the emissions associated with their loan portfolios compared to net-zero emissions pathways. (Sept 2022)

STANDARD CHARTERED / ADM — International banking group, Standard Chartered, and ADM launched the bank’s first Green Trade Export Letter of Credit program. This $500 million program will help ADM expand its sustainable farming practices and source sustainably produced goods, primarily soybeans, oilseeds, and cotton, and will be supported by third-party certification mechanisms. (Aug 2022)

CARBONPLACE / VISA — Completed a successful test of the new Carbonplace payment platform designed to increase the efficiency, transparency, and security of carbon credit purchases. The blockchain-based Carbonplace platform was developed by seven banks—BNP Paribas, CIBC, Itau Unibanco, National Australia Bank, NatWest Group, Standard Chartered, and UBS—to be “the SWIFT of the carbon offset market.” In the pilot transaction, CEF member Visa purchased Verra-certified carbon credits from Sustainable Carbon, a leading carbon credit project developer, as part of Visa’s pledge to achieve net-zero emissions by 2040. The Carbonplace platform eliminates the need for purchasers to perform their own vetting of carbon credit providers or maintain their own private registries of purchased carbon credits. It is expected to launch in late 2022 and could play a key role in driving more private sector capital toward climate change solutions. (May 2022)

STANDARD CHARTERED — Announced it will end all direct coal financing for clients by 2032. The London-based bank ended new coal financing in 2018 but will now be phasing out legacy financing as part of the bank’s amended climate policy. (April 2022)

2021

STANDARD CHARTERED — Announced new interim targets and methodology for its pathway to achieve net-zero by 2050, including (Nov 2021):

- Expect all clients in the power generation, mining and metals, and oil and gas sectors to have a decarbonization transition strategy in line with the goals of the Paris Agreement by 2022

- Stop funding companies expanding in thermal coal (at an individual client entity level), and only provide financial services to clients with less than 5% revenue dependence on the fuel by 2030

- Reduce absolute financed thermal coal-mining emissions by 85% by 2030

- Reduce sector revenue-based carbon intensity by 63% for power, 33% for steel and mining (excluding thermal coal), and 30% for oil and gas by 2030

- Mobilize $300 billion in green and transition finance

Steel Climate-Aligned Finance Working Group — A new RMI-led working group involving 6 banks—Citi, Goldman Sachs, ING, Société Générale, Standard Chartered, and UniCredit—to develop a climate-aligned finance agreement to support decarbonization of the steel sector.

The agreement will include a framework for measuring progress against climate targets and act as a platform for proactive engagement with the steel sector. The group aims to finalize the agreement before COP26. (June 2021)

MORE »

Zeronomics (Standard Chartered) — Based on a global study of 250 senior executives and 100 investment specialists, reviews how well companies are transitioning to net-zero, obstacles, and opportunities to accelerate the global decarbonization of business. Key findings (March 2021):

- Companies are moving too slowly: 55% of companies say they’re not transitioning fast enough, and 78% of investors say most business leaders are failing to take action required to transition their company by 2050

- A lack of finance is the greatest barrier to transitioning to net-zero: 85% of companies require medium or high levels of investment to transition to net zero; 91% for carbon-intensive companies

- Carbon-intensive industries and emerging markets are struggling most: Developed markets are receiving more investments, and carbon-intensive sectors in emerging markets will experience the most significant capital shortfall

- Net-zero is not seen as commercially viable: 64% of senior executives believe it’s not currently commercially viable to operate as a net-zero emissions business

- Key actions would speed up transition: Standardized global measurement and disclosure frameworks would accelerate adoption, as would increased pressure from supply chain partners and investors, more evidence of cost savings, and an effective global carbon tax

Prince Charles’s Sustainable Markets Initiative announced the executive members of its Financial Services Task Force (FSTF), which prior to COP26 aims to: (1) produce credible pathway for how banks can achieve net-zero emissions; (2) accelerate private investment flows into sustainable infrastructure projects; and (3) help develop “a deep and liquid global market for high-quality carbon credits.” Chaired by HSBC Group Chief Executive Noel Quinn, the FSTF includes the top executives from Bank of America, Barclays Plc, BNP Paribas, Citi, Coutts, Credit Suisse, Lloyds, Macquarie, NatWest Group and Standard Chartered Bank. (February 2021)